Assuming that they have no current bills other than those that are listed, what is their current ratio?

Tim and Autumn Davis are trying to figure out their current financial health. They will pay off their car loan in three years, their gross household income is $5,700 per month, and they receive $95 per month in interest income from their investments. They have listed the following items from their most recent statements.

Savings account: $3,200

Checking account: $1,800

Credit card balance: $3,000

Car loan balance: $18,000

Car market value: $15,000

Furniture market value: $4,000

Stocks and bonds: $15,000

A) 0.79 times

B) $5,000/$3,000

C) 2 times

D) Not enough information available

Answer: B

You might also like to view...

Which of the following occurs when a person has already invested in a course of action, and does not recognize what they invested initially is gone?

A. sunk costs fallacy B. satisficing C. hindsight bias D. overconfidence bias

Emotive customers are frank, demanding, serious, and opinionated

Indicate whether the statement is true or false

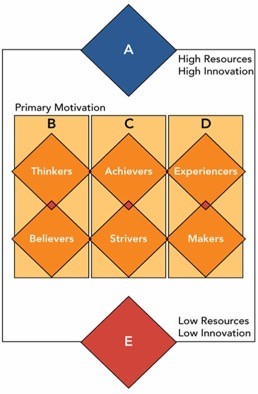

VALS FrameworkVALS creates profiles of people based on their primary motivation and resources. In the VALS framework above, B refers to

VALS FrameworkVALS creates profiles of people based on their primary motivation and resources. In the VALS framework above, B refers to

A. Achievement. B. Self-Expression. C. Ideals. D. Innovators. E. Survivors.

________ is an accounting approach based on specific accounting requirements set by governmental taxing agencies.

A. Forensic accounting B. Benchmarking C. Managerial accounting D. Tax accounting