Individual Retirement Accounts and 401(k) plans make the current U.S. tax system

a. more like a consumption tax and so more like the tax system of many European countries.

b. more like a consumption tax and so less like the tax system of many European countries.

c. less like a consumption tax and so more like the tax system of many European countries.

d. less like a consumption tax and so less like the tax system of many European countries.

a

You might also like to view...

The typical average cost curve

A. continually declines as output increases. B. is horizontal. C. continually increases as output increases. D. first declines to a minimum and then increases as output increases.

The Bureau of Economic Analysis releases last quarter's growth rate in real GDP. This release would most likely have been written by what kind of an economist?

A. A monetary economist B. A macroeconomist C. A microeconomist D. A labor economist AACSB: Reflective Thinking

The government imposing a minimum wage is an example of an attempt to:

A. correct a market failure. B. redistribute surplus in a market. C. encourage the consumption of inferior goods. D. discourage the consumption of inferior goods.

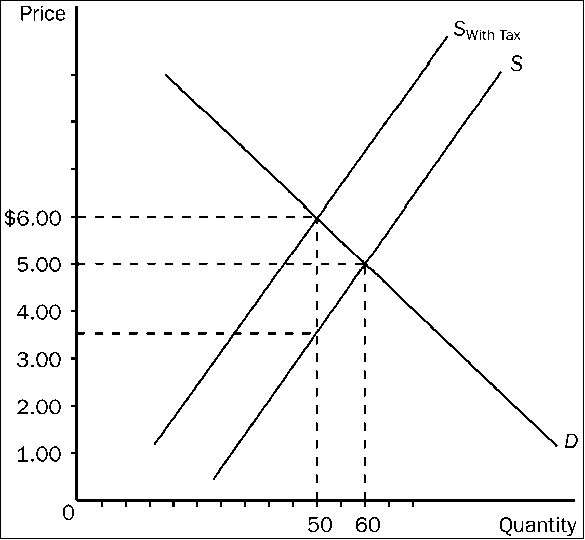

Figure 4-22

Refer to . Buyers pay how much of the tax per unit?

a.

$1.00.

b.

$1.50.

c.

$2.50.

d.

$3.00.