Suppose the interest rate is zero and the public expects the price level to fall by 2%. Which of the following statement is true?

A) The value of money falls by 2%.

B) Money becomes an interest earning asset; it earns a nominal interest rate of 2%.

C) Money becomes an interest earning asset; it earns a real interest rate of 2%.

D) Bonds and money will become perfect substitutes since both are non-interest earning assets.

Ans: C) Money becomes an interest earning asset; it earns a real interest rate of 2%.

You might also like to view...

Members of the European Union decided to adopt a single currency by what year?

A) 2008 B) 2005 C) 1999 D) 1992

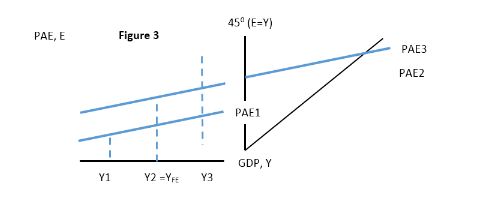

Using Figure 3 below, suppose that the economy was at Y2. This level of GDP would be considered:

A. inflationary.

B. recessionary.

C. a long run level of output.

D. unsustainable over time.

Economic growth guarantees economic development.

Answer the following statement true (T) or false (F)

If the government imposes a maximum price that is above the equilibrium price,

A. demand will be greater than supply. B. quantity demanded will be less than quantity supplied. C. this maximum price will have no economic impact. D. the available supply will have to be rationed with a nonprice rationing mechanism.