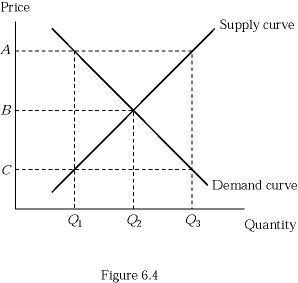

Refer to Figure 6.4. If a market experiences excess demand and fails to maximize total surplus, a maximum price must have been set at:

Refer to Figure 6.4. If a market experiences excess demand and fails to maximize total surplus, a maximum price must have been set at:

A. A.

B. B.

C. C.

D. There is not sufficient information.

Answer: C

You might also like to view...

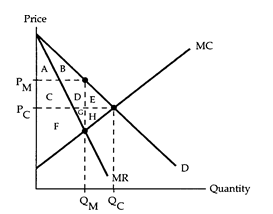

Refer to the market diagram. Of the surplus that the consumers lose because there is a monopoly (and not perfect competition), how much has become deadweight loss?

The following questions refer to the accompanying market diagram. PC and QC are the equilibrium price and quantity if the firm behaves competitively, and PM and QM are the equilibrium price and quantity if the firm is a simple monopoly.

a. Area E

b. Area H

c. Area E + H

d. Area C + D + H

Under the Global Legal Settlement of 2002, the provision that requires, for a period of five years, brokerage firms to contract with independent research firms to provide information to their customers is an example of

A) regulate for transparency. B) supervisory oversight. C) separation of functions. D) socialization of information production.

Suppose Juliana owns a small business making handbags. Each month she makes 18 handbags, which she sells for $100 each. The materials used to make each handbag cost $50. In addition, Juliana uses a spare room in her house to make the handbags and store her supplies. If she were not using the spare room for her business, she would use it as a guest room, an option that Juliana would value at $250 per month. If Juliana weren't making handbags, she would work at Trader Joe's earning $800 per month. What is Juliana's economic profit each month?

A. $900 B. $650 C. ?$150 D. $750

Explain how the exchange rate gets determined in a flexible exchange rate system.

What will be an ideal response?