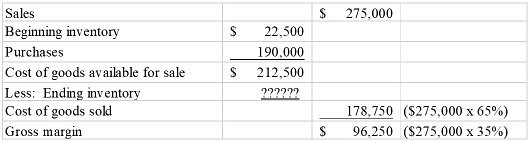

The Byrne Company had its entire inventory destroyed when a fire swept through the company's warehouse on April 30, Year 2. Fortunately, the accounting records were locked in a fireproof safe and were not damaged. The following information for the period up to the date of the fire was taken from the accounting records: Sales$275,000Purchases190,000Beginning inventory22,500Required: Assuming that the gross margin has averaged 35%, what is the estimated value of the inventory destroyed in the fire?

What will be an ideal response?

$33,750

Inventory lost is computed by plugging the missing figure: $212,500 ? $178,750 = $33,750

You might also like to view...

If the goods delivered by the seller do not conform to the contract, ________.

A. the buyer can pay for the units accepted at a price lower than the price per unit provided in the contract B. the buyer cannot reject an installment delivery even if the nonconformity substantially affects the value of that delivery C. the buyer can accept any commercial units and reject the rest D. the buyer can accept only part of a commercial unit and reject the rest

The anxiety that people often experience when they move from a familiar culture to one that is entirely different is known as

A. traumatic stress syndrome. B. readjustment syndrome. C. brain drain. D. expatriate syndrome. E. culture shock.

Corporate income taxes are reported as a separate expense item on the income statement

Indicate whether the statement is true or false

An overdraft occurs when a

a. bank allows a customer to write checks for more than the amount of money on deposit. b. customer writes a bad check. c. bank cashes a check that is more than three months old. d. bank cashes a check dated after the actual date of issue.