How does the imposition of a penalty for selling an illegal drug influence demand, supply, price, and the quantity of the drug consumed?

What will be an ideal response?

If the penalty is levied on the seller, the penalty is added to the minimum price required for supplying the good or service. The demand curve remains unchanged but the supply curve shifts leftward, so that the vertical distance between the initial supply curve and the supply curve with the penalty equals the dollar value of the penalty. In this case, the equilibrium price of the good rises and the equilibrium quantity decreases.

You might also like to view...

Entry causes the competitive firm's demand curve to fall

Indicate whether the statement is true or false

When a tax is imposed on a good for which both demand and supply are very elastic, a. sellers effectively pay the majority of the tax

b. buyers effectively pay the majority of the tax. c. the tax burden is equally divided between buyers and sellers. d. None of the above is correct; further information would be required to determine how the burden of the tax is distributed between buyers and sellers.

The Board of Governors of the Federal Reserve System has how many governors?

A. 7 B. 5 C. 12 D. 50

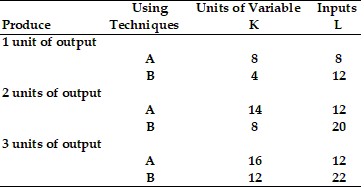

Refer to the information provided in Table 8.1 below to answer the question(s) that follow.

Table 8.1  Refer to Table 8.1. Assuming the price of labor (L) is $5 per unit and the price of capital (K) is $10 per unit, which of the following statements is true?

Refer to Table 8.1. Assuming the price of labor (L) is $5 per unit and the price of capital (K) is $10 per unit, which of the following statements is true?

A. The firm will use production technique A to produce all three units of output. B. The firm will use production technique A to produce the first unit and production technique B to produce the second and third units of output. C. The firm will use production technique B to produce the first two units of output and production technique A to produce the third unit of output. D. The firm will use production technique B to produce all three units of output.