Which of the following functions of government gives property owners the incentive to use their property efficiently?

A) making sure that courts are lenient on people who steal private property

B) the protection of property rights

C) the enforcement of antitrust legislation

D) the financing of public goods

Answer: B

You might also like to view...

Which of the following factors contribute to economic growth?

a. growth in physical capital b. technological advances c. an increase in the productivity of labor d. all of the above

Jane is willing to pay $50 for the first ice cream, $40 for the second ice cream, $30 for the third, and $20 for the fourth. If each ice cream costs $20, Jane's total consumer surplus is _____

a. $60 b. $80 c. $50 d. $30

Compute the tax rates for the three taxpayers shown in Table 33.1. Then use the table to answer the indicated question.TaxpayerIncome (Dollars)Taxable Income (Dollars)Taxes Paid (Dollars)Effective Tax Rate(Percent)Nominal Tax Rate(Percent)1$200,000$100,000$6,000________%________%2100,00080,0008,000________%________%360,00048,00012,000________%________%In Table 33.1, the effective tax rate for taxpayer 3 is

A. 20.0 percent. B. 5.0 percent. C. 25.0 percent. D. 8.0 percent.

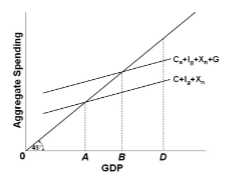

Refer to the diagram. If the full-employment GDP is Y 5 , government should:

A. incur neither a deficit nor a surplus.

B. cut taxes and government spending by equal amounts.

C. reduce taxes and increase government spending.

D. increase taxes and reduce government spending.