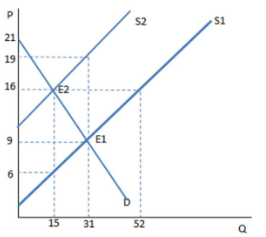

Does a tax on sellers affect the supply curve?

A. Yes, it shifts to the left by the amount of the tax.

B. Yes, it shifts to the right by the amount of the tax.

C. Yes, it shifts up by the amount of the tax.

D. No, there is change in the quantity supplied, but the supply curve does not move.

C. Yes, it shifts up by the amount of the tax.

You might also like to view...

A fixed exchange rate system reduces the impact of

A) variations in the demand for real money balances on real incomes. B) the volatility of aggregate expenditures on real incomes. C) crowding out from fiscal expenditures. D) the beggar-thy-neighbor effect.

Figure 32-1

?

A. Y4 B. Y3 C. Y2 D. Y1

For the labor force to definitely increase,

A. People must turn from being discouraged workers into people actively seeking employment. B. There must be an increase in immigration. C. There must be an increase in total population. D. None of the choices are correct.

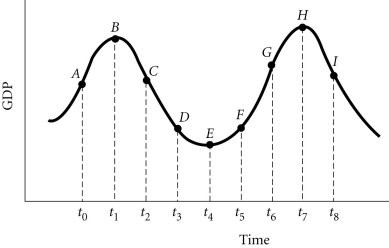

Refer to the information provided in Figure 29.1 below to answer the question(s) that follow. Figure 29.1Refer to Figure 29.1. If policy makers decide on a policy at point t3 but it does not affect the economy until period t6, then the policy choice is likely to be

Figure 29.1Refer to Figure 29.1. If policy makers decide on a policy at point t3 but it does not affect the economy until period t6, then the policy choice is likely to be

A. automatically stabilizing. B. optimal. C. destabilizing. D. stabilizing.