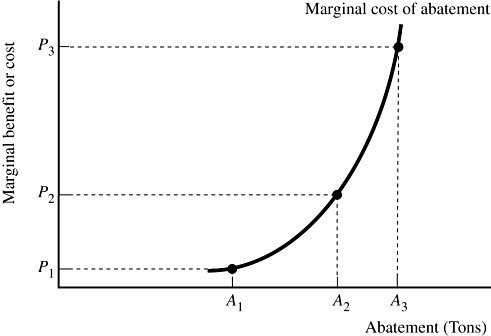

Figure 16.1A firm that generates pollution is illustrated in Figure 16.1. The government has chosen to impose a pollution tax equal to P2. From the firm's point of view, the marginal benefit of abatement is:

Figure 16.1A firm that generates pollution is illustrated in Figure 16.1. The government has chosen to impose a pollution tax equal to P2. From the firm's point of view, the marginal benefit of abatement is:

A. avoiding the pollution tax imposed by the government.

B. the positive publicity the firm will receive by having a "green" production plant.

C. the reciprocal of the marginal cost of abatement.

D. zero because abatement benefits the general public, not the firm.

Answer: A

You might also like to view...

The benefits of urbanization include: crime, pollution, increased taxation and congestion

Indicate whether the statement is true or false

A meditation class meets on the second floor of a building; the first floor is a nightclub. The loud music from the club disturbs the classes. The club could be soundproofed for a cost of $5,000 or move at a cost of $8,000 . The class can't soundproof enough to overcome the music, but could be moved for $4,000 . According to Coase,

a. the club should be soundproofed so both businesses can stay open b. the club should be soundproofed because it is the one generating the externality c. the club should move rather than be soundproofed because eliminating an externality is better than compensating for it d. the class should move because it can eliminate the externality at a lower cost than can the nightclub e. whichever business has been there longer has the overriding property right; the other should adjust

Deflation

a. reflects falling price levels b. was prevalent during the oil shocks of the 1970s c. under the current trends will cause consumers' purchasing power to shrink d. has been persistent in the U.S. economy since the Great Depression e. is the same as stagflation

How did the global supply of savings impact the formation of the housing bubble?

What will be an ideal response?