Welfare economics is the study of how the allocation of resources affects economic well-being.

a. the allocation of resources affects economic well-being.

b. price controls work

c. the government helps poor people.

d. to produce greater equality.

a

You might also like to view...

Suppose an import-competing firm is imperfectly competitive. Replacement of an export tariff with an import quota that yields the same level of imports will ________ market price, ________ producer surplus, ________ consumer surplus, ________

government revenue, and ________ overall domestic national welfare. A) increase; increase; decrease; decrease; decrease B) have no effect on; have no effect on; have no effect on; decrease; decrease C) increase; have no effect on; decrease; decrease; increase D) increase; increase; increase; decrease; have an ambiguous effect on E) decrease; decrease; increase; decrease; increase

In 2012, direct government purchases equaled ________ percent of federal outlays

A) 42 B) 71 C) 26 D) 55

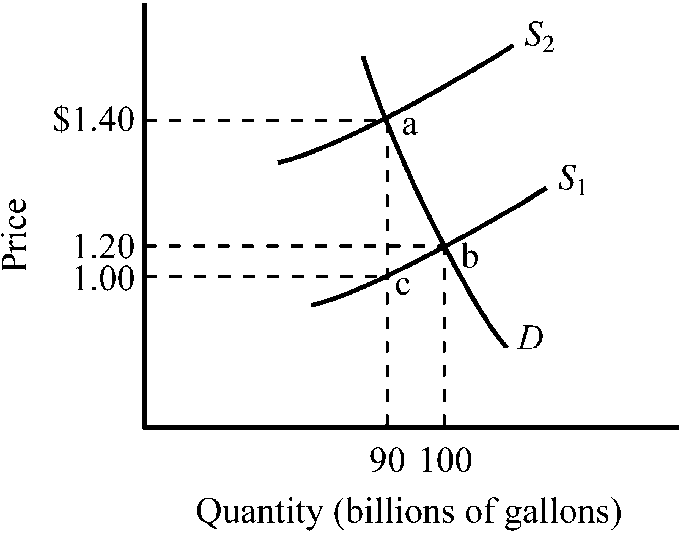

Figure 4-9

Refer to . The market for gasoline was initially in equilibrium at point b and a $.40 excise tax is illustrated. How much revenue would the $.40 gasoline tax raise?

a.

$18 million

b.

$36 million

c.

$72 million

d.

$100 million

If the government's provision of a subsidy is too large to counteract the entire effect of a positive externality, the:

A. total surplus will be maximized. B. quantity consumed will become even lower. C. quantity consumed will become too high. D. None of these statements is true.