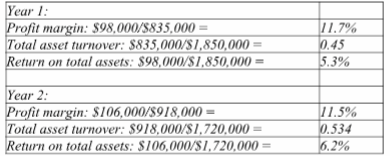

A company reported net income for Year 1 of $98,000 and $106,000 for Year 2. It also reported net sales of $835,000 in Year 1 and $918,000 in Year 2. The company's average total assets in Year 1 were $1,850,000 and $1,720,000 in Year 2. Calculate the company's profit margin, total asset turnover and return on total assets for Year 1 and Year 2. Comment on the results.

What will be an ideal response?

The company did not increase its profit margin from Year 1 to Year 2; however, it did increase its total asset turnover, mainly because total assets declined with no ill effects on sales. The effect is an overall increase in return on total assets.

You might also like to view...

EOQ is a technique of analyzing all incremental costs associated with acquiring and carrying particular items of inventory

Indicate whether the statement is true or false

Details of the division of net income for a partnership should be disclosed

a. in the assets section of the balance sheet b. in the partners' subsidiary ledger c. in the statement of cash flows d. in the partnership income statement

A document or agreement giving the terms of the bond and the rights and duties of the borrower and other parties to the contract that provides some protection to the bondholders and typically limits the borrower's right to declare dividends, to make other distributions to owners, and to acquire other businesses is known as a

a. bond sinking fund agreement. b. serial bond funding agreement. c. bond indenture. d. creditor indenture. e. business trust indenture.

A student portfolio should be created during a capstone class

Indicate whether the statement is true or false