Assume that the central bank increases the reserve requirement. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions become more negative (or less positive).

b. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions remain the same.

c. The quantity of real loanable funds per time period and reserve-related (central bank) transactions remain the same.

d. The quantity of real loanable funds per time period rises, and reserve-related (central bank) transactions remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.B

You might also like to view...

With respect to diffusion of responsibility, the diffusion effect is always greater than the size effect

Indicate whether the statement is true or false

If there are negative externalities that spill across governmental borders, this provides a justification for _____

a. private action b. larger governments c. smaller governments d. intergovernmental competition

Which real-world market most closely approximates perfect competition?

a. the stock market b. automobiles c. higher education d. cable television services e. retail clothing stores

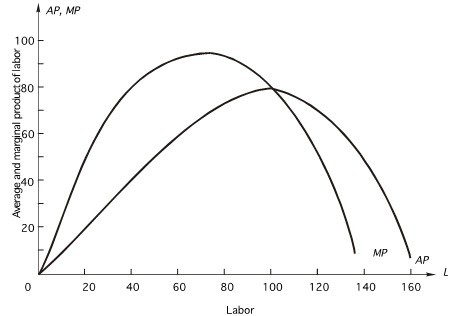

The following graph shows the marginal and average product curves for labor, the firm's only variable input. The monthly wage for labor is $2,800. Fixed cost is $160,000. When the firm uses 120 units of labor, how much output does it produce?

When the firm uses 120 units of labor, how much output does it produce?

A. 7,500 units B. 7,000 units C. 70 units D. 8,400 units E. 9,200 units