Suppose the money multiplier in the United States is 3. Suppose further that if the Fed increases the discount rate by 1 percentage point, banks initially change their reserves by 400. To reduce the money supply by 4,200 the Fed should:

A. raise the discount rate by 10.5 percentage points.

B. raise the discount rate by 3.5 percentage points.

C. reduce the discount rate by 3.5 percentage points.

D. reduce the discount rate by 10.5 percentage points.

Answer: B

You might also like to view...

How is the probability of an event defined?

What will be an ideal response?

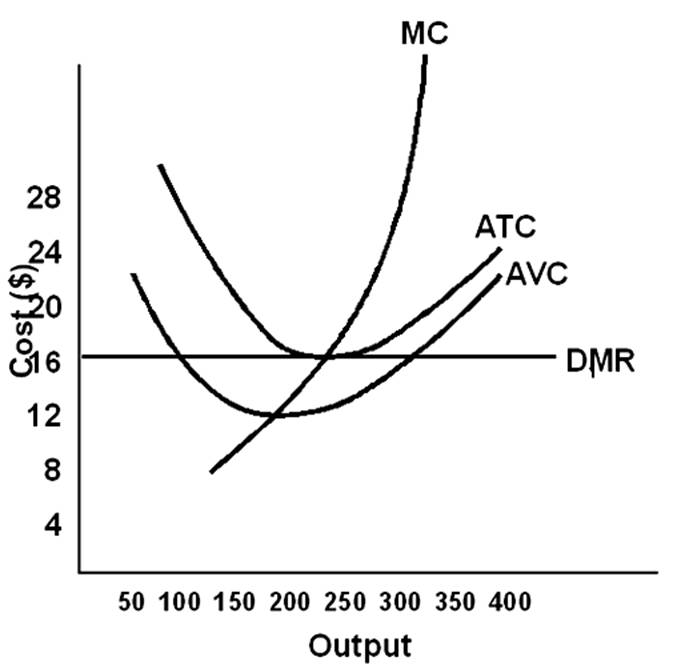

Which of the following about costs is true?

a. The difference between the ATC and AVC curves will decline as output expands. b. The AFC will remain constant as output increases. c. If ATC is increasing, then AVC must be greater than ATC. d. Implicit costs and fixed costs are always the same.

Suppose that in a country the total holdings of banks were as follows: required reserves = $45 million excess reserves = $15 million deposits = $750 million loans = $600 million Treasury bonds = $90 million Show that the balance sheet balances if these

are the only assets and liabilities. Assuming that people hold no currency, what happens to each of these values if the central bank changes the reserve requirement ratio to 2%, banks still want to hold the same percentage of excess reserves, and banks don't change their holdings of Treasury bonds? How much does the money supply change by?

If the price were $25, how much would the firm's output be in the short run?