Suppose the observed annual quantity of steel exchanged in the European market is 30 million metric tons, and the observed market price is 90 euros per ton. If the price elasticity of demand for steel is -0.3 in Europe, what is an appropriate value for the price coefficient (b) in a linear demand function ?

A. b = -0.9

B. b = 0.9

C.b = 0.1

D. b = -0.1

D. b = -0.1

You might also like to view...

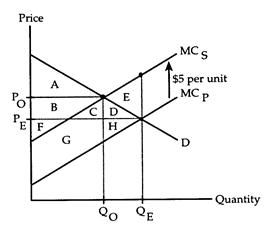

Refer to Negative Externality. Suppose there are no transactions costs. Also suppose the externality is internalized when the damaged parties offer producers a bribe of $5 per unit to reduce their production. Coase's analysis indicates that social gain in this situation will equal

The following questions refer to the accompanying diagram, which shows the effects of a negative externality created by an industry's production. The equilibrium quantity in the absence of any attempt to internalize the externality is QE, and the optimal quantity according to a Pigovian analysis is QO.

a. area A + B + F.

b. area A + B + F - E.

c. area A + B + C + D + F + G + H.

d. area A + B + C + F + G.

Once a monopoly has determined how much it produces, it will charge a price that

A) is determined by the intersection of the marginal cost and average total cost curves. B) minimizes marginal cost. C) is determined by its demand curve. D) is independent of the amount produced. E) is equal to its average total cost.

Open-market purchases by the Fed make the money supply

a. increase, which tends to increase the value of money. b. increase, which tends to decrease the value of money. c. decrease, which tends to decrease the value of money. d. decrease, which tends to increase the value of money.

The sum of past federal budget deficits is the:

a. Congressional debt. b. GDP debt. c. national debt. d. trade debt plus GDP.