By NOT taxing capital gains separately from ordinary income, what would happen to the government's stream of revenue?

What will be an ideal response?

It would be greatly reduced.

You might also like to view...

When considering changes in tax policy, economists usually focus on

A) people's ability to pay taxes. B) the marginal tax rate. C) the average tax rate. D) people's willingness to pay taxes.

A newspaper headline announces that "more college graduates than ever are in the labor force." This is an example of

a. microeconomic analysis b. an abstraction c. a value judgment d. a positive statement e. macroeconomic analysis

Which of the following is an example of imports?

a. Sugar bought from a retail shop b. Steel bars sold to other countries c. Clothes bought from another country d. Apples bought from a farmer

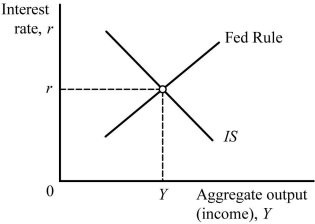

Refer to the information provided in Figure 26.5 below to answer the question(s) that follow. Figure 26.5Refer to Figure 26.5. A decrease in the price level shifts the ________ to the ________.

Figure 26.5Refer to Figure 26.5. A decrease in the price level shifts the ________ to the ________.

A. Fed rule; left B. Fed rule; right C. IS curve; right D. IS curve; left