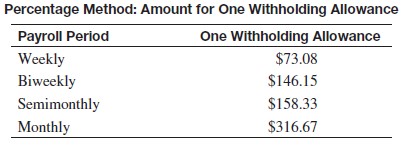

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $115,000 so far this year.

Thomas McKnight has gross earnings of $22,012.15 monthly. He is married and has 8 withholding allowances.

Thomas McKnight has gross earnings of $22,012.15 monthly. He is married and has 8 withholding allowances.

A. $24,608.96

B. $17,731.41

C. $20,328.22

D. $16,047.48

Answer: D

Mathematics

You might also like to view...

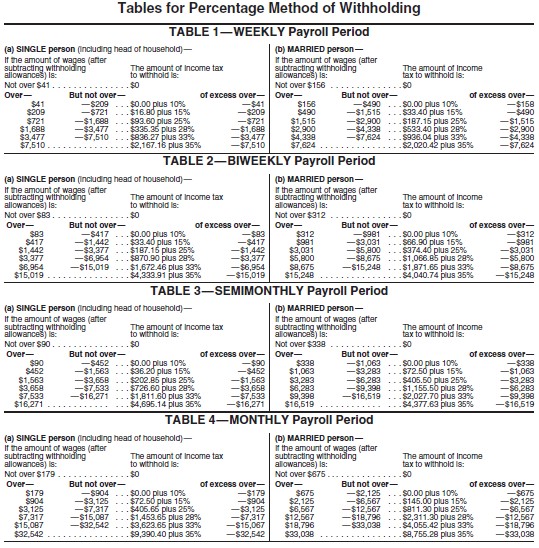

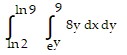

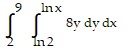

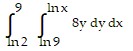

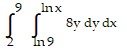

Write an equivalent double integral with the order of integration reversed.

A.

B.

C.

D.

Mathematics

Find the value of (f ? g)' at the given value of x.f(u) =  , u = g(x) = 2x2 + x + 2, x = 0

, u = g(x) = 2x2 + x + 2, x = 0

A.

B.

C.

D. -

Mathematics

Simplify using order of operations.

A. -11 B. 8 C. 11 D. -8

Mathematics

Use the table of z-scores and percentiles to find the percentage of data items in a normal distribution that lie a. above and b. below the given score.z = -0.9

A. 18.41%, 18.41% B. 81.59%, 18.41% C. 0%, 100% D. 18.41%, 81.59%

Mathematics