Discuss why saving and investing entails risk. What is the reward for bearing risk? Explain how income taxes affect the returns to risk bearing and its impact on overall risk taking and innovation

What will be an ideal response?

Saving and investing entails risk because individuals are bearing the burden of the possibility that investments might not pay out or that inflation might erode the value of savings. The reward for bearing risk is above-normal profits. The higher the risk, the higher the potential for above-normal profits. Income taxes reduce the return on bearing risk. On the other side, however, government does not subsidize losses from risk taking. Thus, income taxes create a bias against risk taking and innovation.

You might also like to view...

If Year 1 is the base year, the growth of real GDP is approximately

A) 100%. B) 109.5%. C) 137.5%. D) 148%.

If a bottle of fine French wine costs US$250 in the U.S., 2500 rand in South Africa, there are transaction costs of US$50, and the exchange rate is 20 rand/US$, then

A) there is an arbitrage opportunity by buying the wine in the U.S., and selling it in South Africa and the price in South Africa will drop. B) there is an arbitrage opportunity by buying the wine in South Africa., and selling it in the U.S. and the price in the U.S. will drop. C) here is an arbitrage opportunity by buying the wine in South Africa., and selling it in the U.S. and the price in the U.S. will rise. D) there is no arbitrage opportunity.

A friend says, "I really, really need a new car." As an economist, you're thinking

A) Right! Everyone needs a new car. B) This is an example of how objectively undefinable needs are. Many would argue that this friend could get along just fine with a reliable used car. C) If this friend says she needs a new car, then we must all agree that a new car is a need and not just a want. D) that a new car can only be considered a need if at least 51% of the public agrees.

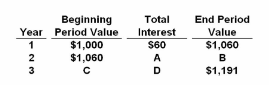

Refer to the table representing Darcy's bank account. Assuming that $1,000 was deposited into her account at the beginning of year 1, and no further deposits or withdrawals were made, the $1,191 value at the end of year 3 represents the:

A. discounted value of the $1,000 deposit made at the beginning of year 1.

B. present value of the $1,000 deposit made at the beginning of year 1.

C. future value of the $1,000 deposit made at the beginning of year 1.

D. present value of the interest earned over the three-year period.