If you focus on interest-rate risk, can you explain why banks offer higher interest rates on longer-term CDs than they do on short-term CDs?

What will be an ideal response?

In looking at bank balance sheets one important difference is that bank assets tend to be long term and its liabilities tend to be short term. This mismatch between maturities creates interest-rate risk. One way to reduce the risk for banks is to try to move more liabilities from short to long term. By offering higher rates on longer-term CDs banks may be able to lure savers from shorter-term to longer-term CDs thus increasing the average maturity of the banks' liabilities.

You might also like to view...

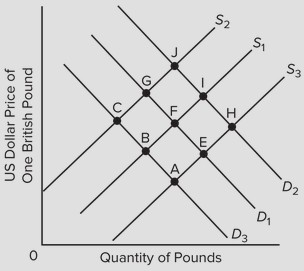

Use the following graph, which shows the supply and demand for British pounds, to answer the next question. D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wants to fix the exchange rate at its initial level, then it should ________.

D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wants to fix the exchange rate at its initial level, then it should ________.

A. buy U.S. dollars to add to its reserves B. sell U.S. dollars out of its reserves C. buy British bonds in the open market D. sell British pounds in the foreign exchange market

An increase in the user cost of capital leads firms to ________ their profit by ________ their capital-output ratio

A) raise, increasing B) raise, decreasing C) lower, increasing D) lower, decreasing

If the short-run aggregate supply curve is positively sloped and the Fed increases the money supply, aggregate demand: a. falls, which increases real GDP and the price level

b. increases, which decreases real GDP and the price level. c. falls, which decreases real GDP and increases the price level. d. increases, which decreases real GDP and increases the price level. e. increases, which increases real GDP and the price level.

Which of the following explains why flood control is a public good?

A. It is not divisible and therefore cannot be kept from people who do not pay. B. Flood control is paid for by taxpayers. C. There are external benefits associated with its consumption. D. The private sector usually produces flood control projects.