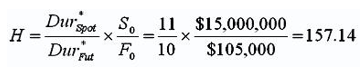

A hedge fund owns a $15 million bond portfolio with a modified duration of 11 years and needs to hedge risk, but T-bond futures are available only with a modified duration of the deliverable instrument of 10 years. The futures are priced at $105,000. The proper hedge ratio to use is ______.

A. 143

B. 157

C. 196

D. 218

B. 157

You might also like to view...

The employee's earnings record would contain which data that the payroll register would probably notcontain?

a. deductions b. payment c. earnings d. cumulative earnings

Which of the following statements is false?

a. Cash equivalents are included in cash on the balance sheet and on the statement of cash flows. b. Investments in cash equivalents and investments in stock have the same economic effect--assets increase and decrease by the same amount. c. An investment is a cash equivalent if it is convertible into a known amount of cash and has an original maturity of 3 months or less when purchased. d. Investments in stock are reported as a financing activity on the statement of cash flows.

In monetary-unit sampling, population size is:

A. the dollar balance in an account. B. unrelated to sample size. C. the number of items in an account. D. included in the denominator of the formula to determine sample size.

Which of the following is the following question an example of?

"On a scale of 1 to 5, how do you rate the friendliness of Olive Garden's wait staff?" A) Likert scale B) one-way labeled scale C) importance scale D) unimportance scale E) un-anchored n-point scale