Sharon buys some common stock in 1990 for $10,000 and sells it in 2000 for $15,000. During the same period, prices have risen by 75 percent. The net result of Sharon’s stock purchases is that she will

A. pay no taxes because she earned negative real capital gains.

B. lose purchasing power and have to pay taxes anyway.

C. earn a real capital gain of $5,000 plus 75 percent.

D. earn a real capital gain of $15,000 minus 75 percent.

Answer: B

You might also like to view...

Less-developed countries that nonetheless have access to the latest technologies must be suffering from a relative shortage of ________ according to the Solow growth model, implying a very ________ rate of return available on additions to capital in

those countries. A) capital, low B) capital, high C) labor, low D) labor, high

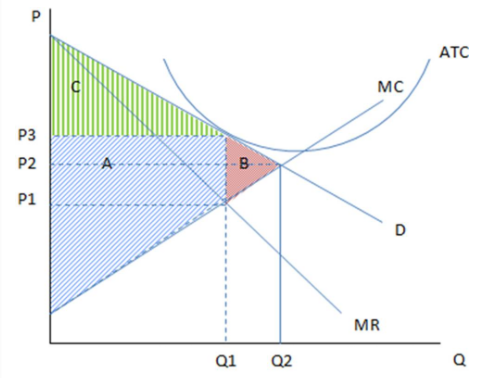

Assuming the firm in the graph is producing Q1 and charging P3, it is likely:

These are the cost and revenue curves associated with a firm.

A. in long-run equilibrium.

B. an efficient outcome.

C. not maximizing profits.

D. operating at a loss.

A good example of the government commandeering resources is

a. government subsidizing road construction b. the Pharaohs building the pyramids c. Bill Gates creating Windows 95 with a government issued patent d. Thomas Edison inventing the light bulb e. government taxing Disneyland

A firm might issue stock to

A. to increase its debt. B. decrease the number of owners. C. employ more people. D. finance a capital project.