The efficacy of tax incentives as an instrument of activist fiscal policy

A) has been proven to be very substantial in the view of most economists.

B) is not plagued by a substantial lag between the passage of tax legislation and the resulting investment spending.

C) is subject to debate but still is limited by the "legislative lag."

D) has been proven to be so limited that it is no longer considered to be a serious option by most economists.

C

You might also like to view...

European households wishing to purchase shares of stock in an American company are ________ the foreign exchange market.

A. demanders of Euros in B. demanders of U.S. dollars in C. suppliers of U.S. dollars in D. supplied dollars by the European Central Bank for use in

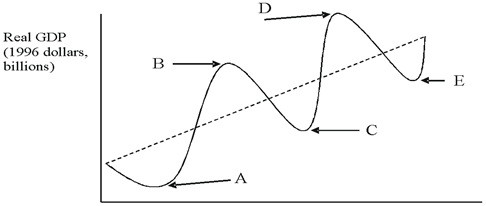

Refer to the figure below.  In the figure, a business cycle trough is shown by which point(s)?

In the figure, a business cycle trough is shown by which point(s)?

A. D only B. B and D C. A and C and E D. A only

Vault cash is part of a commercial bank's

A) demand deposits. B) capital. C) reserves. D) liabilities.

Suppose that changes in the interest rate have absolutely no effect on the demand for money. The resulting ________ LM curve causes monetary policy to have ________ effect in changing income

A) horizontal, no B) horizontal, an unusually strong C) vertical, no D) vertical, an unusually strong