If the Fed expands the money supply by $1 trillion, what will happen in the money market?

a. The equilibrium interest rate will rise, and less money will be exchanged in equilibrium.

b. The equilibrium interest rate will fall, and more money will exchanged in equilibrium.

c. The equilibrium interest rate will not change.

d. None of the above.

b

You might also like to view...

Yield management is the practice of

A) forecasting competitors' responses to price changes. B) using information technology to find the best interest rate. C) determining production functions to minimize production costs. D) using buyer data to rapidly adjust prices.

Explain the exchange rate over-shooting hypothesis

What will be an ideal response?

The incidence of a payroll tax is borne by both employers and employees

a. True b. False Indicate whether the statement is true or false

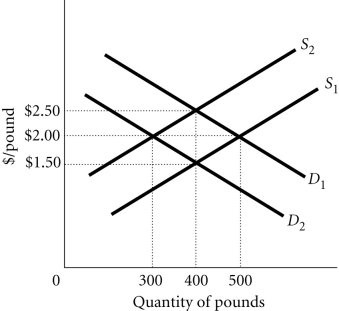

Refer to the information provided in Figure 34.4 below to answer the question(s) that follow. Figure 34.4Refer to Figure 34.4. The demand and supply of pounds are D2 and S2. If the demand shifts to D1 and supply remains unchanged at S2

Figure 34.4Refer to Figure 34.4. The demand and supply of pounds are D2 and S2. If the demand shifts to D1 and supply remains unchanged at S2

A. the dollar depreciates and the equilibrium quantity of pounds decreases. B. the dollar appreciates and the equilibrium quantity of pounds decreases. C. the dollar depreciates and the equilibrium quantity of pounds increases. D. the dollar appreciates and the equilibrium quantity of pounds increases.