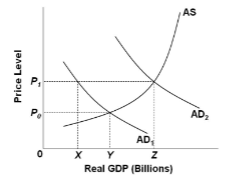

Refer to the figure. Suppose that the economy is currently operating at the intersection of AS and AD 2 , and that the full-employment level of output is Y. Because of the ratchet effect:

A. it is impossible to enact fiscal policy that will both reduce output to Y and reduce demand-

pull inflation.

B. fiscal policy will need to be more contractionary to reduce output to Y than if no ratchet

effect occurred.

C. tax increases will be more effective at reducing demand-pull inflation than cuts in

government spending.

D. contractionary fiscal policy that shifts aggregate demand to AD 1 will cause real GDP to fall below its full-employment level.

D. contractionary fiscal policy that shifts aggregate demand to AD 1 will cause real GDP to fall below its full-employment level.

You might also like to view...

All else held constant, the international value of foreign currencies will increase against the U.S. dollar if ________.

A. U.S. citizens reduce spending on imports B. there are withdrawals of funds by foreigners from U.S. money markets C. there is an increase in the number of foreign tourists in the United States D. the U.S. Federal Reserve raises real interest rates

All else equal, as the price of oil falls, potential profits from producing oil ________ which ________ oil companies to look for additional sources of oil

A) increase; encourages B) increase; discourages C) decrease; encourages D) decrease; discourages

Fill in the blank: According to your textbook, "Fiscal policy is simply ________."

A) budget policy B) monetary policy under a different name C) price policy D) wage policy E) stupid

The "expected real" interest rate is the

A) rate actually quoted in financial markets. B) rate actually quoted in financial markets minus the expected inflation rate. C) rate actually quoted in financial markets plus the expected inflation rate. D) rate actually quoted in financial markets divided by the expected inflation rate.