What are tax loopholes and what are their effects?

What will be an ideal response?

A tax loophole is a special provision in the tax code that reduces taxation below normal rates (perhaps to zero) if certain conditions are met. They can exist for several reasons: One is a perceived need for horizontal or vertical equity. A second is that a person, firm, or industry has engaged in effective rent seeking and has obtained a tax advantage. The effects of loopholes are to encourage particular patterns of behavior and/or to discourage other patterns of behavior. Many loopholes benefit the wealthy; this tends to erode the progressivity of a progressive income tax.

You might also like to view...

Answer the next question based on the following price and output data over a five-year period for an economy that produces only one good. Assume that year 2 is the base year.YearUnits of OutputPrice per Unit18$22103315441855206If year 2 is the base year, then real GDP in year 5 is ________.

A. $90 B. $60 C. $30 D. $120

When dealing with negative externalities, government action is required

A) only if transactions cost are low. B) for any bargain to be successful. C) only in environmental disputes. D) only if transactions costs preclude bargaining between polluter and victim.

For most macroeconomists

A) gross national income and gross national product are the same. B) gross national income exceeds gross national product. C) gross national product exceeds gross national product. D) it is hard to tell whether gross national income equal gross national product. E) gross national product is much more important than gross national income.

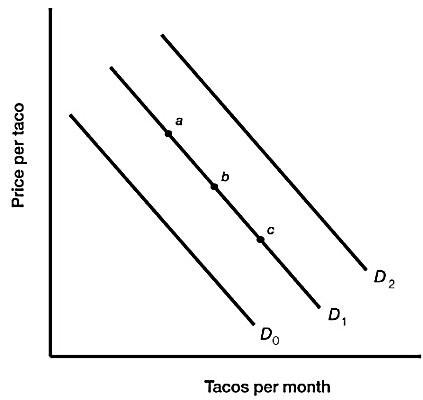

Figure 3.4 illustrates the demand for tacos. Assume that tacos and beer are complements. An increase in the price of beer would bring about a movement from:

Figure 3.4 illustrates the demand for tacos. Assume that tacos and beer are complements. An increase in the price of beer would bring about a movement from:

A. point a to point b. B. point c to point b. C. D2 to D1. D. D0 to D2.