The concept of time preference in financial investing rests on the belief that people:

A. are indifferent between present and future consumption.

B. are patient.

C. are impatient.

D. intentionally consume 50 percent of assets in the present and 50 percent in the future.

C. are impatient.

You might also like to view...

Economists have found that firms are

A) less likely to change prices as a result of shocks to the aggregate economy than shocks limited to the firm's particular sector. B) more likely to change prices as a result of shocks to the aggregate economy than shocks limited to the firm's particular sector. C) equally likely to change prices as a result of shocks to the aggregate economy as they are shocks limited to the firm's particular sector. D) unlikely to change prices as a result of both shocks to the aggregate economy and shocks limited to the firm's particular sector.

If as a result of NAFTA the demand for American exports rises, it would tend to increase the exchange value of the U.S. dollar as a result

a. True b. False Indicate whether the statement is true or false

What is the opportunity cost of economic growth?

a. investment in the current time period b. improved technology in the current time period c. capital goods in the current time period d. consumption in the current time period

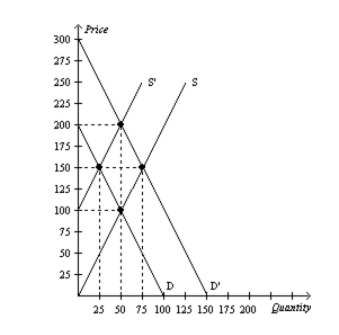

Refer to Figure 7-11. If the demand curve is D and the supply curve shifts from S’ to S, what is the change in producer surplus?

a. Producer surplus increases by $625

b. Producer surplus increases by $1875

c. Producer surplus decreases by $625

d. Producer surplus decreases by $1875