Which of the following statements does not properly reflect the new rules for accounting for minority equity investment securities, if fair value is not readily determinable?

A. If reported at cost, the reported value is updated when circumstances indicate the asset's value is impaired.

B. If reported at cost, the reported value is to be updated when there is an observable transaction.

C. If there are changes in carrying value, they are not to be reported in net income.

D. Firms may opt to report at fair value or report at cost.

Answer: C

You might also like to view...

Unified paragraphs present ideas in a logically connected way

Indicate whether the statement is true or false.

As a human resource manager, Chloe seeks to make human resource technology a part of daily operations at Acme Global. She points out how it can be used in all areas of human resources. Chloe is helping Acme Global become agile by ______.

A. creating a digital culture B. developing the ability to thrive on change C. exploring the value of “on-demand” workers D. reviewing legacy processes

The unadjusted trial balance at the end of the year includes the following: Accounts Receivable$196,000 Allowance for Doubtful Accounts 2,000 Both accounts have normal balances. The company uses the aging of accounts receivable method. Its estimate of uncollectible receivables resulting from the aging analysis equals $11,600. What is the amount of Bad Debt Expense to be recorded for the year?

A. $11,600 B. $13,600 C. $15,600 D. $9,600

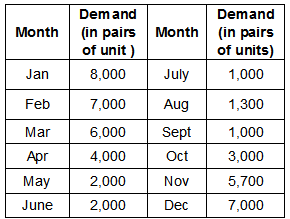

Consider the estimated aggregate demand for a company’s ski product line for the upcoming year in the following table. Calculate the total costs for the month of March using the level production strategy. Assume the regular time production cost as $200/pair of skis, and the average monthly inventory holding cost is $20/pair of skis per month.

a. $810,000

b. $900,000

c. $880,000

d. $850,000