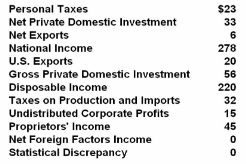

Refer to the data. Personal income is:

A. $229.

B. $253.

C. $274.

D. $243.

D. $243.

You might also like to view...

Refer to Scenario 25-2. As a result of Kristy's deposit, Bank A's reserves immediately increase by

A) $2,000. B) $8,000. C) $10,000. D) $50,000.

In the circular flow model, households derive income from all of the following categories except

a. wages earned by labor b. revenue earned by firms c. profit earned by entrepreneurs d. rent earned by people providing land resources e. interest earned by people providing capital resources

Annuity Due

What will be an ideal response?

Suppose that government imposes a specific excise tax on product X of $2 per unit and that the price elasticity of supply of X is unitary (coefficient = 1). If the incidence of the tax is such that the consumers of X pay $1.85 of the tax and the

producers pay $0.15, we can conclude that the: A. supply of X is highly inelastic. B. supply of X is highly elastic. C. demand for X is highly inelastic. D. demand for X is highly elastic.