If a third party pays for an individual to consume a good, how is the decision making of consumers affected? How does this affect the actions of suppliers?

When spending their own money, consumers will search for the best deal and patronize those suppliers who provide them with the most value per dollar of expenditure. When someone else is paying all or most of the bill, however, consumers will tend to patronize those suppliers thought to provide the highest quality. Why worry about either price or quantity consumed when someone else is paying the bill? Thus, third-party payments reduce the price sensitivity of consumers and encourage them to choose both a higher quality and larger quantity than would be the case if they were paying with their own money.

Because consumers are less sensitive to price, suppliers have less incentive to provide their goods and services at economical prices. Rather than providing value per dollar, suppliers get ahead by providing higher quality (including services that are only marginally related to the primary good) under a third-party payment system. Predictably, both prices and expenditure levels will tend to increase rapidly when the cost of a good or service is paid for by a third party.

You might also like to view...

In a certain economy, the components of aggregate spending are given by:C = 100 + 0.9(Y - T) - 500rI = 150 - 1,000rG = 200NX = 50T = 100Given the information about the economy above, what is the short-run equilibrium output if the real interest rate is 6 percent?

A. 320 B. 3,200 C. 3,500 D. 450

Some college students have claimed that because their incomes will be higher as a result of attending college, there is no opportunity cost of attending college. Do you agree? Explain.

What will be an ideal response?

Although the long-run equilibrium price of oil is $80 per barrel, some producers have much lower costs because their oil reserves are relatively close to the surface and are easier to extract

If the low-cost producers have a minimum LAC equal to $20 per barrel, then the difference ($60 per barrel) is: A) an above-normal economic profit. B) an economic rent due to the scarcity of low-cost oil reserves. C) a profit that will go to zero as new oil producers enter the market. D) none of the above

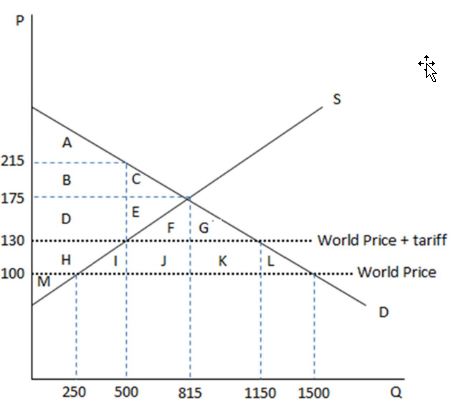

According to the graph shown, if the economy were to open to free trade, it would become:

This graph demonstrates the domestic demand and supply for a good, as well as a tariff and the world price for that good.

A. a net-importer.

B. a net-exporter.

C. an autarky.

D. less efficient with less overall market surplus.