The Basketball Division of Thunder Sports Enterprises reported the following financial data for the year: Assets available for use $1,200,000 Book Value $1,500,000 Market Value Residual income $108,000 Return on investment 14% Refer to Thunder Sports Enterprises. If the manager of the Basketball Division is evaluated based on return on investment, how much would she be willing to pay for an

investment that promises to increase net segment income by $60,000?

a. $ 108,000

b. $ 300,000

c. $ 428,572

d. $1,200,000

C

$60,000 / 0.14 = $428,572

Business

You might also like to view...

Describe two tests that an auditor would perform to ensure that the disaster recovery plan is adequate

Business

According to the objective theory of contracts, the intent to enter into a contract is judged by the ________.

A. doctrine of equity B. legality of the contract C. reasonable person standard D. common law of contracts

Business

Resources represented by binding constraints are fully used by the optimal solution

a. True b. False

Business

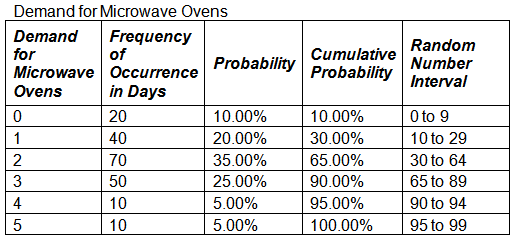

Consider the Demand for Microwave Ovens dataset. What is the total demand corresponding to random numbers 65, 32, 23, 33, 80, and 14?

a. 12

b. 13

c. 14

d. 15

Business