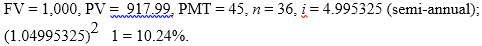

Given the bond described above, if interest were paid semi-annually (rather than annually) and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be

A. less than 10%.

B. more than 10%.

C. 10%.

D. Cannot be determined.

E. None of the options are correct.

B. more than 10%.

You might also like to view...

Which of the following would be considered a committed fixed cost ( a cost that is incurred regardless of the level of activity during the period)?

a. depreciation expense b. bad debt expense c. advertising expense d. cost of goods sold

Which of the following is not an objective of product costing systems?

A) To provide information for cost planning B) To assist in the preparation of the income statement C) To determine the taxable profits D) To provide information for product pricing

_____ are words that look or sound alike but have different meanings

Fill in the blank(s) with correct word

A ____________________ sentence contains two independent clauses and one dependent clause

Fill in the blank(s) with correct word