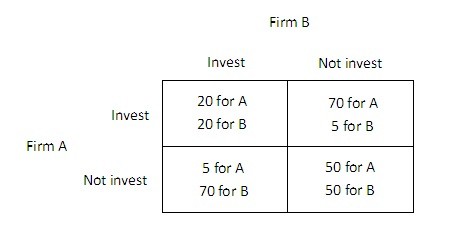

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. How much must the spy pay B?

An industry spy comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. How much must the spy pay B?

A. At least $15 million.

B. At least $50 million.

C. At least $35 million.

D. $0

Answer: A

You might also like to view...

Investment spending is a potent force in the macroeconomy, because ________

A) it is subject to large fluctuations B) it is larger than other spending categories C) it is the focus of macroeconomic policies D) it expresses entrepreneurial talent

A U-shaped long-run average cost curve indicates that

A) economies of scale follow diseconomies of scale. B) diseconomies of scale follow economies of scale C) economies of scale and economies of scope are the same. D) economies of scale dominate diseconomies of scale over all levels of production.

Suppose only 7 percent of Turkey's products go to the United States. Hence, an increase in U.S. imports from Turkey:

a. would have no significant effect on Turkey's domestic income. b. would significantly increase Turkey's domestic income. c. would significantly decrease Turkey's domestic income. d. would significantly increase U.S. domestic income. e. would significantly decrease U.S. domestic income.

The goal of a free trade agreement is to abolish all tariffs among member countries.

a. true b. false