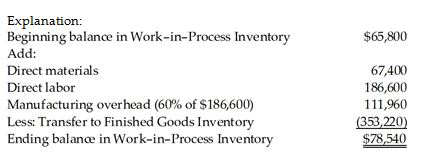

On January 1, Jackson, Inc.'s Work-in-Process Inventory account showed a balance of $65,800. During the year, materials requisitioned for use in production amounted to $70,900, of which $67,400 represented direct materials. Factory wages for the period were $209,000 of which $186,600 were for direct labor. Manufacturing overhead is allocated on the basis of 60% of direct labor cost. Actual overhead was $116,340. Jobs costing $353,220 were completed during the year. The December 31 balance in Work-in-Process Inventory is ________.

A) $65,800

B) $319,800

C) $431,760

D) $78,540

D) $78,540

You might also like to view...

A cereal company includes one premium coupon in every cereal box. Upon returning 10 such coupons to the company, a customer will be sent a free cereal bowl. In a recent year, the company sold 200,000 boxes of cereal for $1 a box. It is estimated that 20% of the coupons will be returned. If the cereal bowls cost the company $3 each, what amount of liability for premium redemptions must be recorded

by the company? a. $ 6,000 b. $ 12,000 c. $ 24,000 d. $200,000

The doctrine of promissory estoppel is also known as the doctrine of beneficial reliance

Indicate whether the statement is true or false

What links producers to consumers through the purchase and reselling of products or contractual agreements?

A. Marketing intermediaries B. Distributors C. Suppliers D. Middle marketers E. Marketing channels

What would you use the Measure-Object cmdlet for?

What will be an ideal response?