If a pollution tax imposed on a firm is greater than its external cost:

A. the externality will be fully internalized.

B. the social production cost will increase by the amount of the pollution tax.

C. the pollution tax will be efficient.

D. from a society's point of view, the firm will be producing too little.

Answer: D

You might also like to view...

The figure above shows that monopoly is ________ because it produces a level of output at which ________

A) inefficient; marginal benefit equals marginal cost B) efficient; marginal benefit equals marginal cost C) efficient; marginal benefit exceeds marginal cost D) inefficient; marginal benefit exceeds marginal cost E) efficient; producer surplus is maximized

The Federal Reserve Open Market Committee meets about ____ times a year

a. 8. b. 12. c. 4. d. 2. e. 24.

Price discounts to selected buyers with the intent of driving out smaller competitors is

a. widespread in all industries b. common in the retailing industry only c. illegal under the Robinson-Patman Act d. allowed if the four-firm concentration ratio is less than 50 percent e. beneficial to consumers in the long run

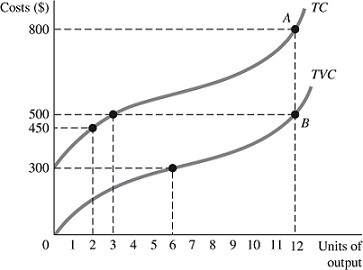

Refer to the information provided in Figure 8.4 below to answer the question(s) that follow.  Figure 8.4 Refer to Figure 8.4. If twelve microwave ovens are produced, Micro Oven's total variable costs are

Figure 8.4 Refer to Figure 8.4. If twelve microwave ovens are produced, Micro Oven's total variable costs are

A. $300. B. $500. C. $800. D. $1,300.