If capital flows freely between countries and a country has a fixed exchange rate, one thing you know is that the country:

A. exports more than it imports.

B. cannot have a discretionary monetary policy.

C. must have ample gold reserves.

D. must be running large trade deficits

Answer: B

You might also like to view...

Will a large quantity of bonds held in the Social Security Trust Fund make it easier to deal with the retirement of the baby boomers?

a. Yes; the federal government will be able to redeem these bonds in the future without raising taxes or increasing its borrowing. b. Yes; the interest on these bonds will provide the federal government with a stream of net revenue in the future. c. Yes, but only if the federal government holds these bonds until they mature. d. No; the federal government cannot redeem the bonds without raising revenues for their redemption from other sources.

Suppose the economy's short-run equilibrium is at a point to the right of Natural Real GDP. Which of the following statements is true?

A) The economy is in an inflationary gap. B) The economy is in a recessionary gap. C) The economy is in long-run equilibrium. D) This situation is actually impossible.

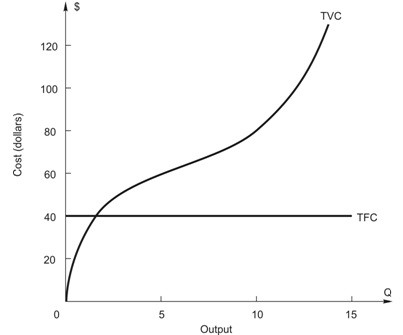

In the above figure, what is the AVERAGE variable cost of producing 5 units of output?

In the above figure, what is the AVERAGE variable cost of producing 5 units of output?

A. $20 B. $80 C. $60 D. $12 E. $40

Compare the Keynesian and monetarist views about how monetary tools should be used.

What will be an ideal response?