Explain why GDP per capita varies among countries even though countries eventually converge to their balanced growth paths

What will be an ideal response?

Balanced growth paths differ among countries due to different saving rates, labor force growth rates, and the rates of labor-augmenting technological change. Because of this, countries experience conditional convergence, where each country converges to its own balanced growth path as opposed to the same balanced growth path for all countries. The differences in balanced growth paths among countries account for the differences in GDP per capita for these countries.

You might also like to view...

Which of the following statements best explains the effects of transfer payments and taxes on aggregate spending? a. Transfer payments and taxes affect aggregate spending directly, just as consumption does

b. Transfer payments and taxes affect aggregate spending indirectly by first changing disposable income and thereby changing consumption. c. Changes in the amount of transfer payments and taxes cancel each other and therefore have no influence on any economic variable. d. Transfer payments and taxes affect disposable income but have no effect on consumption. e. Transfer payments affect disposable income, but taxes do not.

The characteristics that money should have include:

a. portability, durability, and flexibility. b. durability, flexibility and stability. c. durability, portability, and non-homogeneity. d. scarcity, portability, and divisibility. e. portability, homogeneity, and flexibility.

Athos, Porthos,and Aramis each like to take fencing lessons. The price of a fencing lesson is $10 . Athos values a fencing lesson at $15, Porthos at $13, and Aramis at $11 . Suppose that if the government taxes fencing lessons at 50 cents each, the price rises to $10.50 . A consequence of the tax is that consumer surplus shrinks by

a. $1.50 and tax revenues increase by $1.50, so there is no deadweight loss. b. $9.00 and tax revenues increase by $1.50, so there is a deadweight loss of $7.50. c. $7.50 and tax revenues increase by $7.50, so there is no deadweight loss. d. $7.50 and tax revenues increase by $1.50, so there is a deadweight loss of $6.

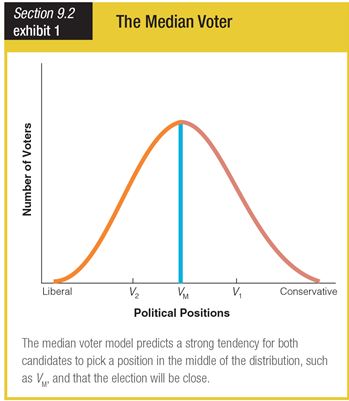

Based on the graph showing the median voter, if candidate A took a position at V1, candidate B would have the best chance to win the election by taking a position ______.

a. just to the left of V1

b. just to the left of V2

c. just to the right of V1

d. exactly at V2