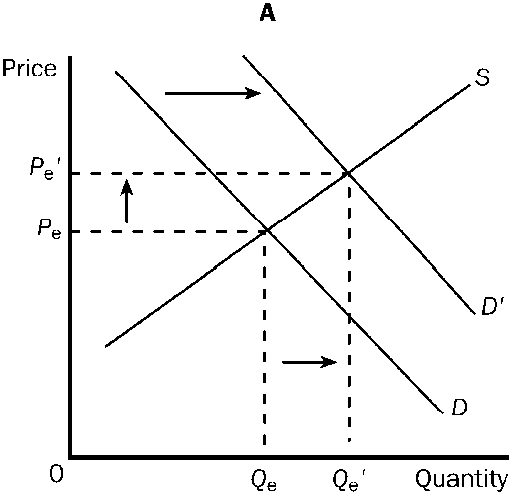

Assume that the central bank purchases government securities in the open market. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and the nominal value of the domestic currency in the context of the Three-Sector-Model?

a. The real risk-free interest rate falls, and nominal value of the domestic currency rises.

b. The real risk-free interest rate falls, and nominal value of the domestic currency falls.

c. The real risk-free interest rate rises, and nominal value of the domestic currency remains the same.

d. The real risk-free interest rate rises, and nominal value of the domestic currency rises.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.B

You might also like to view...

A development bank

(a) accepts deposits from the poor. (b) makes loans for industry expansion. (c) is an agency such as the World Bank. (d) all of the above. (e) none of the above.

The purpose of a chain-weighted price index is to account for:

A) the costs of purchasing wholesale products like chains and industrial goods. B) the changes in the quantities of goods and services purchased over time. C) linkages in price changes among industrialized countries. D) none of the above

If the crowding-out effect is complete and the marginal propensity to save is 0.2, then an increase in government spending of $500 billion will generate how much more real Gross Domestic Product (GDP)?

A. $0 B. $500 billion C. $50 billion D. $400 billion