Suppose that Mexico and Canada both peg their currencies to the U.S. dollar. The relationship between the Mexican peso and the Canadian dollar is best described as a(n):

A) indirect peg.

B) fixed exchange rate system.

C) currency union.

D) free trade area.

Ans: A) indirect peg.

You might also like to view...

During the 1990s, Japan experienced periods of deflation and nominal interest rates that approached zero percent. Why would anyone lending money agree to a nominal interest rate of almost zero percent?

What will be an ideal response?

An example of an entrepreneur would be

A) the owner of a new Indian food restaurant. B) the cafeteria employee who won the employee of the month award. C) a Greyhound bus driver. D) the cashier at your local supermarket.

The marginal factor cost of borrowing $1,000 for new equipment when the interest rate is 10 percent and the MRP is $700 is

a. $1,000 b. $700 c. $100 d. $70 e. $0 since the firm won't borrow $1,000 when the MRP is only $700

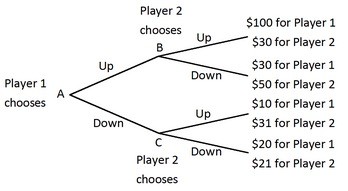

Player 1 and Player 2 are playing a game in which Player 1 has the first move at A in the decision tree shown below. Once Player 1 has chosen either Up or Down, Player 2, who can see what Player 1 has chosen, must choose Up or Down at B or C. Both players know the payoffs at the end of each branch. What is the equilibrium outcome of this game?

What is the equilibrium outcome of this game?

A. Player 1 and Player 2 both choose Down. B. Player 1 chooses Up and Player 2 chooses Down. C. Player 1 chooses Down and Player 2 chooses Up. D. Player 1 and Player 2 both choose Up.