Value-added taxes were introduced in the European Union _____

a. to get rid of inefficient transaction taxes

b. to harmonize tax structures among nations

c. to make taxes more equitable

d. all of the above

e. a and b

e

You might also like to view...

Perfectly competitive firms are earning economic profits at a market price of $12 and an average total cost of $10. If new firms enter and do not affect the cost for all firms, the market price will ________ until it reaches ________.

A) increase; $16 B) decrease; $10 C) decrease; $11 D) increase; $13

The Fed's control of the money supply is not precise because

a. Congress can also make changes to the money supply. b. there are not always government bonds available for purchase when the Fed wants to perform open-market operations. c. the Fed does not know where all U.S. currency is located. d. the amount of money in the economy depends in part on the behavior of depositors and bankers.

Over the past 100 years, as the U.S. economy's income has grown,

a. tax rates have decreased, while tax revenues have increased. b. tax rates have increased, while tax revenues have decreased. c. both tax rates and tax revenues have increased. d. both tax rates and tax revenues have decreased.

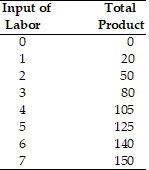

Use the information from the below table to answer following question(s). In the above table, the marginal product of the sixth worker is

In the above table, the marginal product of the sixth worker is

A. 25. B. 10. C. 15. D. 20.