A business fluctuation when the pace of economic activity is slowing down is called

A. a contraction.

B. a slowdown.

C. a reduction.

D. a depression.

Answer: A

You might also like to view...

Which of the following is true about an increase of a per-unit tax in a goods market where the good is quasilinear assuming neither supply nor demand is perfectly inelastic:

A. The more price elastic either demand or supply, the lower will be tax revenue. B. The more price elastic either demand or supply, the greater will be deadweight loss. C. The higher the tax rate, the greater the fraction of deadweight loss over revenue. D. Both (a) and (b) E. Both (b) and (c) F. Both (a) and (c) G. All of the above H. None of the above

The gross public debt is the

A) amount of U.S. paper currency and coins in circulation. B) difference between current government expenditures and tax revenues. C) ratio of past deficits to past surpluses. D) total of all accumulated deficits and surpluses.

Give examples of how government intervention helps reduce moral hazard and adverse selection problems in internal labor markets.

What will be an ideal response?

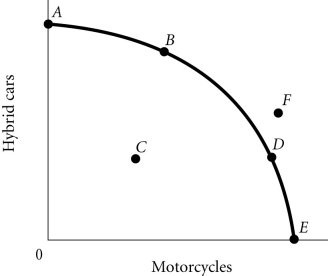

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point F

Figure 2.4According to Figure 2.4, Point F

A. is efficient and attainable. B. cannot be produced with the current state of technology. C. represents underallocation of resources. D. represents what the people want.