Explain the difference between a pension fund that is a defined-contribution plan from one that is a defined-benefit.

What will be an ideal response?

A defined benefit plan has the participant receiving a lifetime retirement income that is determined by their final salary and years of service. This makes it difficult for many people to earn a high retirement income if they have not worked for the firm or the same firm for a very long time. Under a defined contribution plan both the employer and employee make contributions into an account that belongs to the employee. The employer in a DC plan, unlike a DB plan, takes no responsibility for the size of the employee's retirement income.

You might also like to view...

An economy with an expansionary gap will, in the absence of stabilization policy, eventually experience a(n) ________ in the inflation rate, leading to a(n) ________ in output.

A. decrease; increase B. increase; increase C. decrease; decrease D. increase; decrease

The single source of monopolies is economies of scale.

Answer the following statement true (T) or false (F)

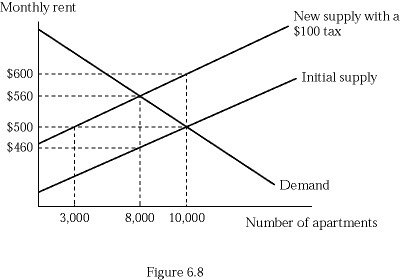

Refer to Figure 6.8. If your city imposes a tax of $100 per apartment:

Refer to Figure 6.8. If your city imposes a tax of $100 per apartment:

A. consumers take the entire burden of the tax. B. landlords take the entire burden of the tax. C. consumers pay $60 and landlords pay $40 tax per apartment. D. consumers pay $40 and landlords pay $60 tax per apartment.

A good or service that is forgone by choosing one alternative over another is called a (an):

a. explicit cost. b. opportunity cost. c. historical cost. d. accounting cost.