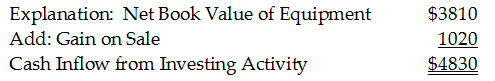

Atlanta Company sold equipment for cash. The income statement shows a gain on the sale of $1020. The net book value of the asset was $3810. Which of the following statements describes the cash effect of the transaction?

A) negative cash flow of $4830 for financing activities

B) negative cash flow of $2790 for operating activities

C) positive cash flow of $4830 from investing activities

D) positive cash flow of $2790 from investing activities

C) positive cash flow of $4830 from investing activities

You might also like to view...

Sports Line, Inc., and Trudy, a consumer, enter into a contract for a sale of a snowmobile. If the contract includes a clause that is perceived as grossly unfair to Trudy, its enforcement may be challenged under the doctrine of

A. good faith. B. impracticability. C. square dealing. D. unconscionability.

An employer may not disqualify a job applicant because of a disability if they can perform the essential functions of the job with reasonable accommodation

Indicate whether the statement is true or false

Which of the following are NOT conventional retailers?

A. limited-line stores B. single-line stores C. general stores D. supermarkets

Differentiate between the two types of informal groups and explain why each might be formed. Provide an example of each.

What will be an ideal response?