Reducing the marginal tax rate on income will

A) raise the return to entrepreneurship and encourage the opening of new businesses.

B) increase the after-tax return on saving, and encourage saving.

C) reduce the tax wedge faced by workers and increase labor supplied.

D) All of the above are correct.

C

You might also like to view...

Private markets will lead to a ________ vaccination rate because:

A. suboptimally low; the external benefit of being vaccinated would not fully be taken into account by decision makers. B. suboptimally high; the external cost of being vaccinated would not fully be taken into account by decision makers. C. socially optimal; price serves as a signal of marginal benefit and marginal cost. D. inequitable; health care services should not be provided based on ability to pay.

An investor has to choose between stocks A&B, each selling for $10 . Stock A, can either increase in price to $12, with a 50% probability or stay at $10 with a 50% probability. Stock B can either increase in price to $15 with a 50% probability or go down to $7 with a 50% probability. Which of the stocks would the investor choose

a. Stock A b. Stock B c. None of the stocks d. The investor would exit the market

In general, when the price of a variable factor of production increases:

A. marginal cost rises. B. the profit-maximizing price falls. C. the profit maximizing level of output rises. D. total cost falls.

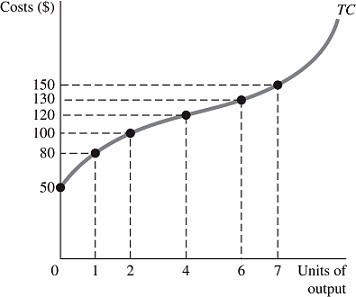

Refer to the short-run information provided in Figure 8.5 below to answer the question(s) that follow.  Figure 8.5 Refer to Figure 8.5. If seven drones are produced, average fixed costs are

Figure 8.5 Refer to Figure 8.5. If seven drones are produced, average fixed costs are

A. $7.14. B. $14.29. C. $20. D. $21.43.