Jimmy acquires an oil and gas property interest for $600,000. Jimmy expects to recover 200,000 barrels of oil. Intangible drilling and development costs are $160,000 and are charged to expense. Other expenses are $40,000. During the year, 25,000 barrels of oil are sold for $800,000. Jimmy's depletion deduction is

A) $120,000.

B) $75,000.

C) $160,000.

D) $600,000.

A) $120,000.

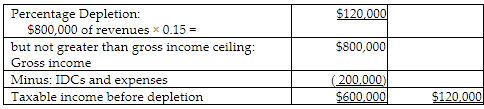

Larger of cost depletion or percentage depletion:

Percentage depletion calculation:

The taxpayer must use the greater of cost or percentage depletion so the $120,000 percentage depletion will be deducted.

You might also like to view...

The International Accounting Standards Board is the primary and most important determinant of generally accepted accounting principles

Indicate whether the statement is true or false

Explain how cannibalization and multibranding are related

What will be an ideal response?

In process costing, each producing department has its own work-in-process account

Indicate whether the statement is true or false

A draft is payable "to the order of Joe Jones or to bearer." Sally finds it and demands payment. Should the drawer pay Sally?

A) No, unless Joe Jones' name is crossed off B) No, unless "bearer" is handwritten C) Yes, an instrument made payable both to order and to bearer is payable to bearer D) Yes, since the instrument is ambiguous, Joe Jones has no right to payment and only the bearer has the right to demand payment