The MedView brochure said, "Only 45 scans per month to cover the monthly equipment rental of $18,000." The footnote at the bottom of the brochure read: *"Assumes a reimbursable fee of $475 per scan." The MedView brochure refers to a new radiology imaging system that MedView rents for $18,000 per month. A "scan" refers to one imaging session that is billed at $475 per scan. Each scan involves giving the patient a chemical injection and requires exposing and developing an X-ray negative.

a. What variable cost per scan is MedView assuming in calculating the 45-scans-per-month amount?

b. Is the MedView brochure really telling the whole financial picture? What is it omitting?

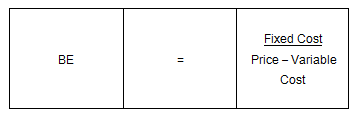

a. The brochure gives the break-even point and the question asks us to calculate variable cost per unit. Or,

Substituting in the known quantities yields:

Solving for the unknown variable cost per unit gives

Variable cost = $75/scan

b. The brochure is overlooking the additional fixed costs of office space and additional variable (or fixed) costs of the operator, utilities, maintenance, insurance and litigation, etc. Also overlooked is the required rate of return (cost of capital). Calculating the break-even point for the machine rental fee is very misleading.

You might also like to view...

With respect to off-price retailing, in a ________ sale, each day at the same time, members receive an e-mail that announces the deals available.

A. consultative B. clearance C. closeout D. flash E. enterprise

Debts due for willful or malicious injury to a person or his property are generally dischargeable in bankruptcy.

Answer the following statement true (T) or false (F)

Enlightened community relations depend upon which of the following?

A) researching, analyzing, and understanding the power structure of communities B) understanding the makeup and expectations of communities C) the organization communicating its point of view in a "top-down" fashion D) each power base making sure it demonstrates who is in charge

On January 1, a company issues bonds dated January 1 with a par value of $300,000. The bonds mature in 5 years. The contract rate is 9%, and interest is paid semiannually on June 30 and December 31. The market rate is 8% and the bonds are sold for $312,177. The journal entry to record the first interest payment using the effective interest method of amortization is:

A. Debit Bond Interest Expense $14,717.70; credit Premium on Bonds Payable $1,217.70; credit Cash $13,500.00. B. Debit Bond Interest Expense $12,487.08; debit Discount on Bonds Payable $1,012.92; credit Cash $13,500.00. C. Debit Bond Interest Expense $12,487.08; debit Premium on Bonds Payable $1,012.92; credit Cash $13,500.00. D. Debit Interest Payable $13,500; credit Cash $13,500.00. E. Debit Bond Interest Expense $12,282.30; debit Premium on Bonds Payable $1,217.70; credit Cash $13,500.00.