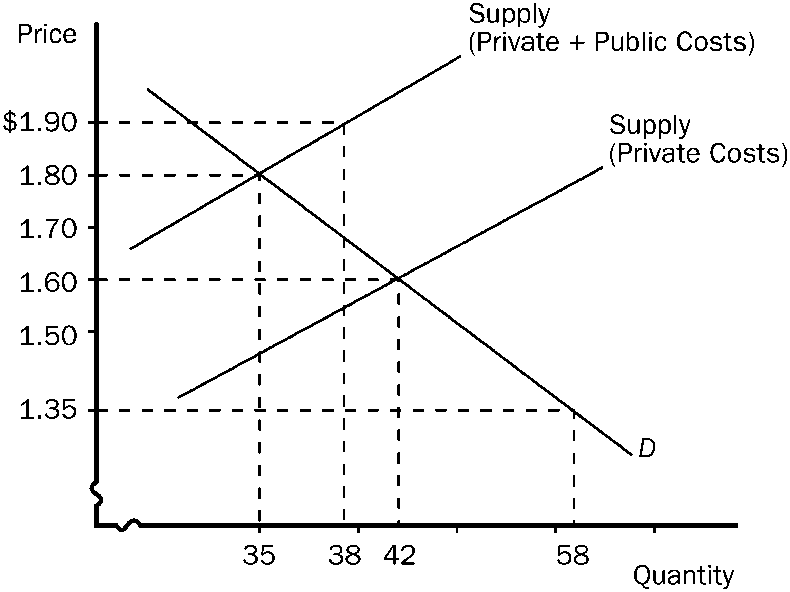

Figure 5-4

Refer to . If the government uses a pollution tax, how much of a tax must be imposed on each unit of production?

a.

$1.90

b.

$1.80

c.

$1.60

d.

$0.30

d

You might also like to view...

The above table gives the demand schedule for Billy Bob's BBQ ribs. An increase in the price of a pound of ribs will lead to a decrease in total revenue when

A) demand is inelastic. B) the demand curve is vertical. C) the price increase occurs over the price range of 0 to $5. D) the price increase occurs over the price range of $5 to $10.

Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000 and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless

Suppose all SUV owners are like Andrew. An insurance company agrees to pay each person who has an accident the full value of his/her SUV. The company's operating expenses are $1,500. What is the minimum insurance premium that the company is willing to accept? A) $1,500 per year B) $4,500 per year C) $3,000 per year D) $6,000 per year

If the bonds of two different countries are identical, their expected returns will:

A. always be equal. B. be equal only if the inflation rate is the same in each country. C. be equal only if the exchange rate between the two countries is fixed. D. be equal if capital flows freely internationally.

A perfectly competitive firm's short-run supply curve is the:

a. demand curve above the marginal revenue curve. b. same as the market supply curve. c. marginal cost curve above the average variable cost curve. d. average total cost curve.