Write out the expression for the Taylor rule. Use the Taylor rule to explain how a decline in real GDP below potential GDP will affect the Federal Reserve's target for the federal funds rate

What will be an ideal response?

The Taylor rule states that the Fed should set the federal funds target so that it is equal to: the real equilibrium federal funds rate + the current inflation rate + (w1 ) × inflation gap + (w2 ) × output gap. The inflation gap is the difference between the current inflation rate and the target rate. The output gap is the percentage difference between real GDP and potential GDP. The values w1 and w2 are weights determined by the Fed. If the growth rate in real GDP is below potential GDP, then the output gap will be negative. This will lower the federal funds target.

You might also like to view...

Which of the following mathematical expressions represents the equation of a straight line with a slope of zero at all points on a graph with Y on the vertical axis and X on the horizontal axis?

A. Y = a + X B. X = bY C. X = a D. Y = a

Refer to Figure 4-3. Kendra's marginal benefit from consuming the third ice cream cone is

A) $13.00. B) $2.50. C) $1.50. D) $0.50.

The GDP of an economy is accurately calculated when: a. the values of both intermediate and final goods are included

b. the values of both intermediate and final goods are excluded. c. the value of intermediate goods are included, while the value of final goods are excluded. d. the value of final goods are included, while the value of intermediate goods are excluded.

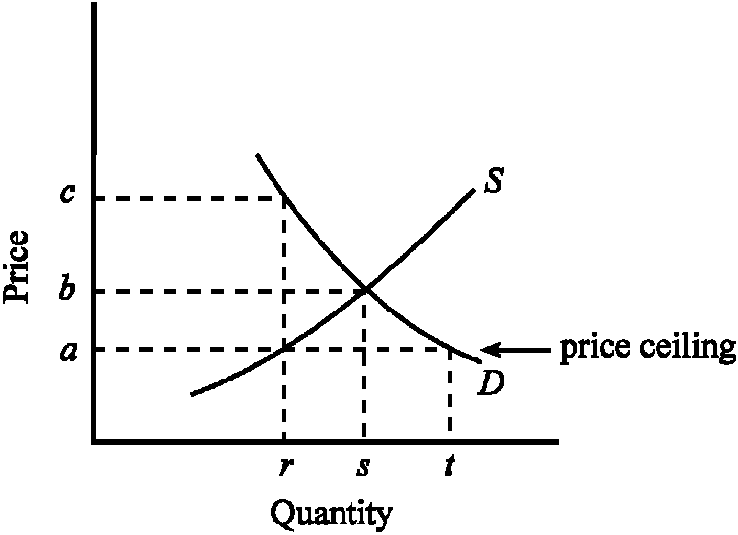

Figure 4-4

Given the demand and supply conditions shown in , if the government imposes a price ceiling of a, which of the following would be true?

a.

Consumers would want to buy r units.

b.

Consumers would want to buy s units.

c.

Producers would wish to sell s units.

d.

Producers would wish to sell r units.