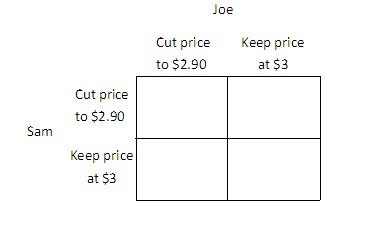

Joe is the owner of the 7-11 Mini Mart, Sam is the owner of the SuperAmerica Mini Mart, and together they are the only two gas stations in town. Currently, they both charge $3 per gallon, and each earns a profit of $1,000. If Joe cuts his price to $2.90 and Sam continues to charge $3, then Joe's profit will be $1,350, and Sam's profit will be $500. Similarly, if Sam cuts his price to $2.90 and Joe continues to charge $3, then Sam's profit will be $1,350, and Joe's profit will be $500. If Sam and Joe both cut their price to $2.90, then they will each earn a profit of $900. You may find it easier to answer the following questions if you fill in the payoff matrix below.

width="383" />For Joe, keeping his price at $3 per gallon is a:

A. profit-maximizing strategy.

B. revenue-maximizing strategy.

C. dominant strategy.

D. dominated strategy.

Answer: D

You might also like to view...

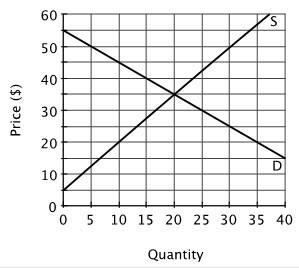

Refer to the figure below. The equilibrium price is ________, and the equilibrium quantity is ________.

A. $30; 15 B. $35; 20 C. $25; 5 D. $25; 20

The price of salsa rises. How does the increase in the price of salsa affect the supply of salsa?

A) The supply of salsa increases. B) The supply of salsa decreases. C) There is no change to either the supply of salsa or the quantity of salsa supplied. D) There is no change to the supply of salsa, but the quantity of salsa supplied increases. E) There is no change to the supply of salsa, but the quantity of salsa supplied decreases.

Use the intertemporal budget constraint — equation (2 ) — to explain how an increase in the real interest rate causes two distinct effects, an income effect and a substitution effect,

and how those effects differ depending on whether the consumer is a saver or a borrower.

Which of the following could decrease the supply of dollars in the foreign exchange market?

a. a higher inflation rate in foreign countries b. lower interest rates in foreign countries c. lower prices in the United States d. an appreciation of other currencies e. a depreciation of the dollar