Between 1929 and 1933, NNP measured in current prices fell from $96 billion to $48 billion. Over the same period, the relevant price index fell from 100 to 75

a. What was the percentage decline in nominal NNP from 1929 to1933?

b. What was the percentage decline in real NNP from 1929 to 1933? Show your work.

a. NNP measured in current prices is nominal NNP. Nominal NNP fell from $96 billion to $48 billion, a decline of 50 percent.

b. Real NNP is nominal NNP divided by the price index and multiplied by 100 . Real NNP in 1929 was ($96 b/100) 100 = $96 b. Real NNP in 1933 was ($48 b/75) 100 = $64 b. Real NNP fell from $96 billion to $64 billion, a decline of 33 percent.

You might also like to view...

Why would a usury law result in banks making less credit available to low-income households?

What will be an ideal response?

Suppose we were analyzing the pound per Swiss franc foreign exchange market. If Switzerland's risk level rises relative to England and nothing else changes, then

a. The supply of Swiss francs in the foreign exchange market falls, and the demand for Swiss francs in the foreign exchange market rises, causing an appreciation of the Swiss franc. b. The supply of Swiss francs in the foreign exchange market falls, and the demand for Swiss francs in the foreign exchange market falls, causing an uncertain change in the value of the Swiss franc. c. Neither supply nor demand in the foreign exchange market change because relative international prices influence trade flows and not the exchange rate. d. The supply of Swiss francs in the foreign exchange market rises, and the demand for Swiss francs in the foreign exchange market falls, causing a depreciation of the Swiss franc. e. The supply of Swiss francs in the foreign exchange market rises, and the demand for Swiss francs in the foreign exchange market rises, causing an uncertain change in the value of the Swiss franc.1.The balance of payments: a. Includes exactly the same transactions that are included in the foreign exchange market. b. Is the sum of all financial payments between residents of one nation and residents of the rest of the world. c. Is a flow concept. d. All the above.

The story of the prisoners' dilemma shows why

a. predatory pricing is clearly not in society's best interest. b. economists are unanimous in condemning resale price maintenance, since it inevitably reduces competition. c. oligopolies can fail to act independently, even when independent decision-making is in their best interest. d. oligopolies can fail to cooperate, even when cooperation is in their best interest.

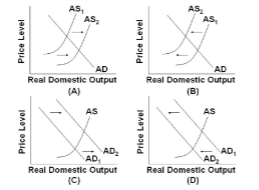

the diagrams best portrays the effects of a decrease in the availability of key natural resources?

Use the following diagrams for the U.S. economy to answer the following question.

A. A.

B. B.

C. C.

D. D.