The random walk theory of stock prices indicates that

a. if they are willing to do a little research, even beginning investors will be able to pick the stocks that will increase most in price in the future.

b. managed mutual funds will persistently earn a higher rate of return than indexed funds.

c. current stock prices already reflect information about factors influencing future stock prices that can be forecast with any degree of accuracy.

d. stock market investors can expect to earn a steady real rate of return of about 7 percent annually.

C

You might also like to view...

Monetarists argue that government deficits financed by monetary expansion cause(s)

A) velocity to increase. B) aggregate demand to increase. C) aggregate demand to decrease. D) no change in aggregate demand or aggregate supply.

Which of the following best describes the policy ineffectiveness proposition?

A) Monetary policy cannot change real GDP in a regular or predictable way. B) Policymakers can be effective in changing real GDP only if people's expectations are correct. C) Monetary policy can change real GDP only if the Fed pursues a consistent, stable growth rate of the real money supply. D) Fiscal policy is totally ineffective in changing real GDP in both the short run and the long run.

Unemployment:

A. can have serious social consequences. B. changes primarily because of macroeconomic forces. C. can create uncertainty about the future. D. All of these are true.

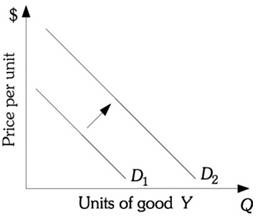

Refer to the information provided in Figure 5.5 below to answer the question that follows. Figure 5.5Refer to Figure 5.5. As the price of good W decreased, the demand for good Y shifted from D1 to D2. The cross-price elasticity of demand between W and Y is

Figure 5.5Refer to Figure 5.5. As the price of good W decreased, the demand for good Y shifted from D1 to D2. The cross-price elasticity of demand between W and Y is

A. negative. B. zero. C. positive. D. indeterminate from this information.