A bundle of goods that costs $1 in the U.S. is worth 5 units in Country A's currency. If Country A's GDP in its own currency is 5,000,000 units, Country A's GDP in purchasing power parity-adjusted dollars is ________

A) $1,000,000 B) $50,000,000 C) $2,500,000 D) $3,000,000

A

You might also like to view...

Suppose the foreign exchange market is in equilibrium. Then, the U.S. government increases borrowing, causing American interest rates to increase. What will happen to the price of the Japanese yen? Why?

What will be an ideal response?

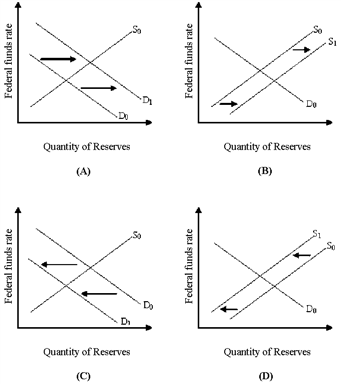

Figure 29-1

?

A. Panel (A) B. Panel (B) C. Panel (C) D. Panel (D)

Two-part pricing offers a mechanism whereby the firm can

A) charge two different prices to distinct groups of customers. B) collect two times as much from consumers as a single-price monopoly can. C) capture some or all of the consumer surplus. D) reduce some of its fixed costs.

If a child is more apt to grow up to become a successful contributing member of society because of an education, this benefit to society is called a

A. positive marginal private cost. B. negative externality. C. positive marginal private benefit. D. positive externality.